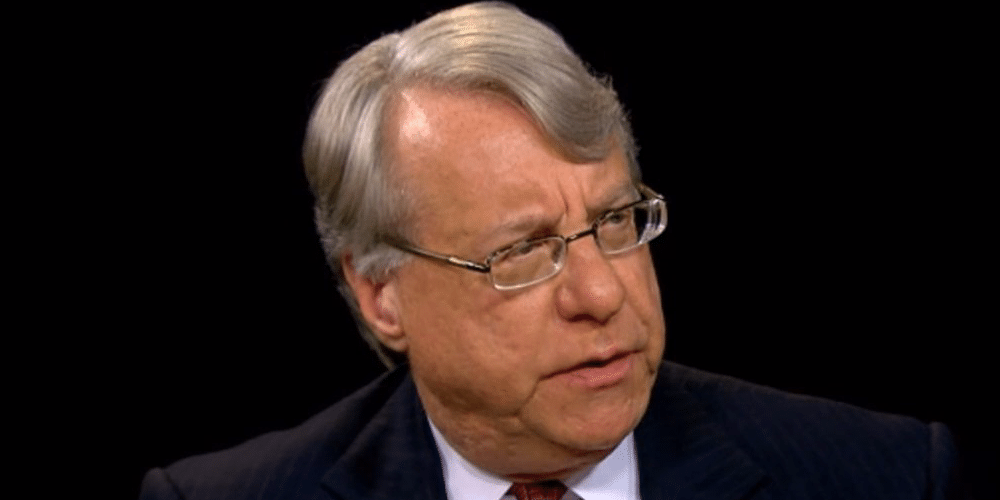

Jim Chanos Net Worth: The Man Who Shorted His Way To Success

When you hear the name Jim Chanos, one thing is certain—this guy’s made a name for himself in the world of finance. Known as one of the most successful short sellers of all time, Chanos has built an empire by spotting weaknesses in companies and betting against them. But how much is Jim Chanos worth, and what’s the story behind his rise? Let’s dive in and uncover the man behind the numbers.

Jim Chanos isn’t your typical Wall Street tycoon. While others focus on buying and holding stocks, Chanos thrives on spotting companies that are overvalued or hiding skeletons in their closets. His knack for identifying troubled companies has earned him a reputation as a master of short selling, a skill that’s both rare and risky. But it’s this very skill that’s led to his massive success.

Before we break down Jim Chanos’s net worth, let’s set the stage. This isn’t just about numbers; it’s about understanding the mindset of a man who’s turned skepticism into a profitable career. So whether you’re a finance enthusiast or just curious about how someone can make billions by betting on failure, this article’s got you covered.

- Alice Rosenbl Leak Unveiling The Truth Behind The Controversy

- Whatrsquos The Hype About Uk Wasmo Telegram Your Ultimate Guide

Biography: Who is Jim Chanos?

Jim Chanos is more than just a name in the finance world—he’s a legend. Born on December 18, 1957, in Milwaukee, Wisconsin, Chanos grew up with a passion for numbers and an eye for detail. But it wasn’t just his natural talent that shaped him; it was his relentless pursuit of truth in the often murky waters of corporate finance.

Chanos’s career took off when he founded Kynikos Associates in 1985. This hedge fund became synonymous with short selling, a practice where investors borrow shares, sell them, and hope to buy them back at a lower price. Chanos’s ability to identify companies that were destined to fail made him a pioneer in this space. His early bets against companies like Enron and Tyco cemented his status as a financial visionary.

But let’s not forget, Chanos isn’t just about the numbers. He’s also a prominent advocate for transparency in corporate America. His work has exposed fraud and unethical practices, making him a hero to some and a nemesis to others. Now, let’s take a closer look at his personal journey.

- Alicia Rosenblum Lealed The Rising Star You Need To Know

- Samantha Lewes The Rising Star Whos Taking The World By Storm

Data and Facts About Jim Chanos

| Full Name | James Edward Chanos |

|---|---|

| Date of Birth | December 18, 1957 |

| Place of Birth | Milwaukee, Wisconsin |

| Education | Yale University |

| Profession | Hedge Fund Manager, Short Seller |

| Net Worth (2023) | Approximately $2.5 billion |

These facts paint a picture of a man who’s not only successful but also deeply committed to his craft. Chanos’s journey from a curious kid in Milwaukee to a billionaire short seller is nothing short of inspiring.

Jim Chanos Net Worth: The Numbers Game

So, how much is Jim Chanos really worth? As of 2023, estimates put his net worth at around $2.5 billion. That’s a pretty impressive figure, especially considering that much of his wealth comes from short selling—a practice that many consider risky. But Chanos isn’t your average risk-taker; he’s calculated, thorough, and incredibly successful.

His wealth isn’t just about the numbers, though. It’s about the impact he’s had on the financial world. Chanos’s short-selling strategies have exposed fraud and unethical practices in some of the biggest companies in the world. His work has led to regulatory changes and increased transparency in corporate finance.

How Did Jim Chanos Build His Wealth?

Chanos’s journey to wealth is a fascinating one. Here are some key milestones:

- 1985: Founding Kynikos Associates – This was the beginning of Chanos’s empire. Kynikos became one of the most successful short-selling hedge funds in history.

- 1990s: Shorting Enron – Chanos’s bet against Enron was one of the most famous short-selling moves in history. It exposed the company’s fraudulent practices and led to its collapse.

- 2000s: Targeting Tyco – Another successful short, Chanos’s work on Tyco helped uncover accounting irregularities and led to significant changes in the company.

- 2010s: Betting Against China’s Real Estate Market – Chanos’s bets against companies like Alibaba and China’s real estate market have been both controversial and profitable.

Each of these moves not only added to Chanos’s wealth but also solidified his reputation as a financial genius.

The Art of Short Selling: Jim Chanos’s Strategy

Short selling isn’t for the faint of heart. It requires a deep understanding of financial statements, market trends, and corporate behavior. Jim Chanos’s approach to short selling is both methodical and intuitive. He looks for companies that are overvalued, have questionable accounting practices, or are hiding significant risks.

Chanos’s strategy involves:

- Extensive Research – He digs deep into financial statements, looking for red flags like inflated revenues or excessive debt.

- Networking – Chanos talks to industry insiders, former employees, and other stakeholders to get a complete picture of a company’s health.

- Patience – Short selling can take time to pay off. Chanos is known for holding his positions for years, waiting for the market to catch up to his analysis.

This approach has made Chanos one of the most respected short sellers in the world. But it’s not without its challenges. Short selling is often misunderstood, and Chanos has faced criticism and even lawsuits from companies he’s targeted. Despite this, he remains undeterred, continuing to expose corporate wrongdoing and profit from it.

Why Short Selling Matters

Short selling isn’t just about making money; it’s also about ensuring market integrity. By identifying and exposing fraudulent companies, short sellers like Chanos help protect investors and maintain trust in the financial system. This is why his work is so important, and why his net worth is more than just a number—it’s a reflection of his impact on the industry.

Jim Chanos’s Impact on the Financial World

Chanos’s influence extends far beyond his personal wealth. He’s been a vocal advocate for transparency and accountability in corporate America. His work has led to regulatory changes, increased scrutiny of financial statements, and a greater awareness of the risks associated with overvalued companies.

One of his most significant contributions has been his role in exposing corporate fraud. His short positions on companies like Enron and Tyco have led to investigations, prosecutions, and significant changes in corporate governance. Chanos’s work has shown that short selling isn’t just a profitable strategy; it’s also a powerful tool for ensuring market integrity.

Chanos’s Advocacy for Transparency

Chanos is more than just a short seller; he’s a champion for transparency. He believes that companies should be held accountable for their actions, and that investors should have access to accurate and complete information. This belief has driven much of his work, and it’s one of the reasons why he’s so respected in the financial world.

Challenges and Criticism: The Dark Side of Short Selling

While Chanos’s success is undeniable, it hasn’t come without challenges. Short selling is often misunderstood, and Chanos has faced criticism from companies he’s targeted. Some have accused him of spreading misinformation, while others have taken legal action against him. Despite this, Chanos remains steadfast in his belief that short selling is a vital part of the financial ecosystem.

One of the biggest challenges Chanos faces is the perception that short sellers are somehow unethical. In reality, short sellers play a crucial role in maintaining market integrity. By identifying and exposing fraudulent companies, they help protect investors and ensure that the market remains fair and transparent.

Responding to Critics

Chanos has never shied away from criticism. Instead, he uses it as an opportunity to educate people about the importance of short selling. He’s written extensively on the subject, explaining how short sellers contribute to market efficiency and protect investors. His work has helped change the perception of short selling, turning it from a misunderstood practice into a respected strategy.

The Future of Jim Chanos: What’s Next?

With a net worth of $2.5 billion and a reputation as one of the most successful short sellers in history, Jim Chanos could easily retire and live a life of luxury. But that’s not in his nature. Chanos is driven by a passion for uncovering the truth, and he shows no signs of slowing down.

Looking ahead, Chanos is likely to continue his work as a short seller, targeting companies that he believes are overvalued or hiding risks. He’s also likely to remain an advocate for transparency and accountability in corporate America. His influence on the financial world shows no signs of waning, and his legacy as a financial visionary is only just beginning.

Chanos’s Legacy

Jim Chanos’s legacy is more than just his net worth; it’s about the impact he’s had on the financial world. By exposing corporate fraud and advocating for transparency, he’s helped protect investors and ensure market integrity. His work has shown that short selling isn’t just a profitable strategy; it’s also a powerful tool for ensuring accountability in corporate America.

Conclusion: Why Jim Chanos Matters

Jim Chanos isn’t just a billionaire short seller; he’s a financial visionary who’s changed the way we think about corporate accountability and market integrity. His net worth of $2.5 billion is a testament to his skill and determination, but it’s his impact on the financial world that truly sets him apart.

As we’ve seen, Chanos’s journey from a curious kid in Milwaukee to a billionaire short seller is one of hard work, dedication, and a relentless pursuit of truth. His work has exposed fraud, protected investors, and ensured that the market remains fair and transparent. And while his methods may be controversial, there’s no denying the importance of his contributions to the financial world.

So, the next time you hear someone talk about short selling, remember Jim Chanos. He’s not just a billionaire; he’s a champion for transparency, a protector of investors, and a true financial visionary. If you’ve enjoyed this article, don’t forget to share it with your friends and leave a comment below. And if you’re looking for more insights into the world of finance, be sure to check out our other articles. Thanks for reading!

Table of Contents

- Jim Chanos Net Worth: The Man Who Shorted His Way to Success

- Biography: Who is Jim Chanos?

- Data and Facts About Jim Chanos

- Jim Chanos Net Worth: The Numbers Game

- How Did Jim Chanos Build His Wealth?

- The Art of Short Selling: Jim Chanos’s Strategy

- Why Short Selling Matters

- Jim Chanos’s Impact on the Financial World

- Chanos’s Advocacy for Transparency

- Challenges and Criticism: The Dark Side of Short Selling

- Responding to Critics

- The Future of Jim Chanos: What’s Next?

- Chanos’s Legacy

- Conclusion: Why Jim Chanos Matters

Detail Author:

- Name : Austyn Feil

- Username : jtowne

- Email : laufderhar@hotmail.com

- Birthdate : 1986-05-22

- Address : 4376 Corwin Underpass Gibsonberg, IA 43011

- Phone : +14795174923

- Company : Collins, Batz and Boyle

- Job : Communication Equipment Repairer

- Bio : Ipsam voluptatem aut optio voluptate. Molestias non ratione impedit reprehenderit. Sunt cumque non et quia. Dolorem laudantium illo eum consequuntur consectetur ut.

Socials

linkedin:

- url : https://linkedin.com/in/apfeffer

- username : apfeffer

- bio : Eos eaque in itaque.

- followers : 6587

- following : 1608

tiktok:

- url : https://tiktok.com/@abe.pfeffer

- username : abe.pfeffer

- bio : Perspiciatis doloribus voluptas amet rerum tempora aut molestiae.

- followers : 2764

- following : 841

instagram:

- url : https://instagram.com/abe6665

- username : abe6665

- bio : Eum et nam culpa autem eos non. Minus quisquam et fugit voluptas. Nihil voluptatem omnis velit qui.

- followers : 3187

- following : 1684

facebook:

- url : https://facebook.com/pfeffera

- username : pfeffera

- bio : Aspernatur officiis veniam corrupti cum.

- followers : 2458

- following : 2568