Used Car Financing Options In Milledgeville: Your Ultimate Guide To Smart Choices

Looking for used car financing options in Milledgeville? You're not alone, my friend. Whether you're a first-time buyer or someone looking to upgrade their ride, navigating the world of car loans can feel like trying to solve a puzzle with missing pieces. But don’t sweat it—we’ve got you covered! In this guide, we’ll break down everything you need to know about financing a used car in Milledgeville, from understanding loan terms to finding the best deals. Let’s dive in, shall we?

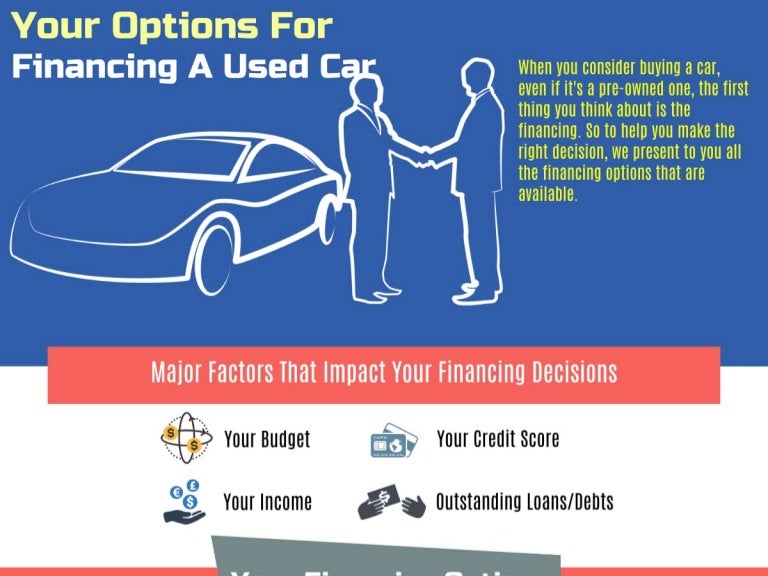

Buying a used car is a smart choice, especially if you're on a budget. But let's face it—most of us don't have the cash lying around to pay for a car upfront. That's where used car financing comes in. In Milledgeville, there are plenty of options to choose from, but it's crucial to know what you're getting into before signing on the dotted line. This guide will help you make informed decisions so you don't end up paying more than you should.

From local dealerships to online lenders, the options are endless. But how do you know which one is right for you? Stick around, and we’ll walk you through the ins and outs of used car financing in Milledgeville. By the end of this, you'll be armed with the knowledge to negotiate like a pro and save some serious dough.

- Alice Rosen Blum Leaked The Story Behind The Headlines

- Melissa Oneil Young Rising Star Of The Modern Era

Table of Contents

- Understanding Used Car Financing

- Types of Used Car Loans

- Interest Rates for Used Cars

- The Role of Credit Scores

- Local Financing Options in Milledgeville

- Exploring Online Lenders

- Tips for Negotiating Your Loan

- How to Avoid Financing Scams

- Leasing vs. Buying: Which is Better?

- Final Thoughts and Action Steps

Understanding Used Car Financing

First things first, what exactly is used car financing? Simply put, it's a loan that helps you pay for a used car over time instead of paying the full amount upfront. This option is perfect for folks who don’t have thousands of dollars sitting in their bank accounts. In Milledgeville, used car financing is a popular choice because it allows buyers to get behind the wheel of a reliable vehicle without breaking the bank.

When you opt for financing, you’ll typically pay a down payment upfront and then make monthly payments until the loan is paid off. The amount you pay each month depends on factors like the loan term, interest rate, and the car's price. Understanding these terms is key to making the right decision.

Why Choose Used Car Financing?

There are plenty of reasons why used car financing is a great option. For starters, used cars depreciate slower than new ones, meaning you’ll retain more value over time. Plus, used car loans often come with lower interest rates compared to personal loans or credit cards. If you play your cards right, you can save big bucks in the long run.

- Alice Rossenblum Leaked Unveiling The Truth Behind The Controversy

- Is Emily Compagno Married Unveiling The Truth Behind The Headlines

Types of Used Car Loans

Not all used car loans are created equal. In Milledgeville, you’ll find a variety of loan types to suit different financial situations. Here’s a quick rundown of the most common ones:

- Direct Lending: This is when you get a loan directly from a bank or credit union before visiting a dealership. It gives you more negotiating power since you already have financing secured.

- Dealer Financing: Many dealerships in Milledgeville offer financing options through their partners. While convenient, these loans might come with higher interest rates, so tread carefully.

- Online Lenders: With the rise of digital banking, online lenders are becoming a popular choice. They often offer competitive rates and flexible terms, making them a great option for tech-savvy buyers.

Which Loan Type is Right for You?

The answer depends on your financial situation and preferences. If you have a good credit score, direct lending might be the way to go. On the other hand, if convenience is your priority, dealer financing could be a better fit. Whatever you choose, make sure you shop around and compare offers before committing.

Interest Rates for Used Cars

Interest rates play a huge role in determining how much you’ll pay for your used car over time. In Milledgeville, rates can vary depending on factors like your credit score, loan term, and the lender you choose. As of 2023, average interest rates for used car loans range from 4% to 10%, but some buyers with excellent credit might qualify for even lower rates.

Here’s a tip: always ask about the APR (Annual Percentage Rate) when comparing loans. The APR includes both the interest rate and any additional fees, giving you a clearer picture of the total cost.

How to Get the Best Interest Rates

Improving your credit score is one of the best ways to secure a low interest rate. Pay your bills on time, keep your credit utilization low, and avoid opening new accounts before applying for a loan. Additionally, consider working with a local credit union, as they often offer better rates than big banks.

The Role of Credit Scores

Your credit score is like a report card for your financial behavior. Lenders in Milledgeville use it to determine how risky it is to lend you money. A higher credit score means you’re more likely to qualify for lower interest rates and better terms. But don’t worry if your score isn’t perfect—there are still options available for buyers with less-than-ideal credit.

Even if you have a lower credit score, you can still get a used car loan. However, you might need to pay a larger down payment or accept a higher interest rate. Over time, as you make timely payments, your credit score will improve, and you might be able to refinance your loan for better terms.

How to Improve Your Credit Score

If your credit score needs a boost, here are a few tips:

- Pay your bills on time every month.

- Keep your credit card balances low.

- Dispute any errors on your credit report.

- Consider a secured credit card to build credit.

Local Financing Options in Milledgeville

When it comes to used car financing in Milledgeville, you’ve got plenty of local options to choose from. From banks to credit unions, these institutions offer personalized service and competitive rates. Here are a few top choices:

- Milledgeville Community Bank: Known for its friendly staff and flexible loan options, this local bank is a great place to start your search.

- Baldwin County Credit Union: As a member-owned institution, this credit union offers lower interest rates and personalized service to its members.

- Georgia Federal Credit Union: With branches throughout the state, this credit union provides a wide range of loan products tailored to meet the needs of its members.

Why Choose Local Lenders?

Supporting local businesses is always a good idea, but there are practical benefits too. Local lenders often have a deeper understanding of the Milledgeville market and can offer more personalized service. Plus, they might be more willing to work with you if you have unique financial circumstances.

Exploring Online Lenders

Online lenders are revolutionizing the way people finance used cars in Milledgeville. With the convenience of applying from home and access to a wide range of loan products, it’s no wonder so many buyers are turning to digital options. Some of the top online lenders include:

- LightStream: Known for its competitive rates and flexible terms, LightStream is a great choice for buyers with good credit.

- Carvana: This online car retailer offers financing options that make buying a used car as easy as shopping for groceries.

- Ally Bank: With a focus on auto loans, Ally Bank provides transparent rates and a seamless application process.

Pros and Cons of Online Lenders

While online lenders offer many benefits, they’re not without drawbacks. On the plus side, they often have lower overhead costs, which translates to better rates for borrowers. However, they might not offer the same level of personal service as local lenders. It’s important to weigh the pros and cons before making a decision.

Tips for Negotiating Your Loan

Negotiating a used car loan can feel intimidating, but with the right approach, you can save hundreds or even thousands of dollars. Here are a few tips to help you negotiate like a pro:

- Shop Around: Get quotes from multiple lenders to ensure you’re getting the best deal.

- Know Your Limits: Set a budget before you start negotiating and stick to it.

- Be Polite but Firm: Don’t be afraid to walk away if the terms don’t meet your expectations.

Common Pitfalls to Avoid

When negotiating a used car loan, there are a few common mistakes to watch out for. Avoid falling for add-ons like extended warranties or service contracts unless you’re sure you need them. Additionally, be wary of dealers who try to upsell you on more expensive models than you originally intended to buy.

How to Avoid Financing Scams

Unfortunately, the world of used car financing isn’t without its share of scams. In Milledgeville, buyers need to be vigilant to avoid falling victim to fraudulent practices. Here’s how to protect yourself:

- Research the Lender: Make sure the lender you’re working with is legitimate and has a good reputation.

- Read the Fine Print: Always review the loan agreement carefully before signing.

- Trust Your Gut: If something feels off, it probably is. Don’t hesitate to walk away from a deal that doesn’t feel right.

Red Flags to Watch For

Some common red flags include unusually low interest rates, pressure to sign quickly, and vague terms in the loan agreement. If you encounter any of these, proceed with caution or seek advice from a trusted financial advisor.

Leasing vs. Buying: Which is Better?

When it comes to used car financing in Milledgeville, buyers often face the dilemma of leasing vs. buying. Both options have their pros and cons, and the right choice depends on your lifestyle and financial goals.

Leasing: If you prefer driving a new car every few years and don’t mind higher monthly payments, leasing might be the way to go. However, keep in mind that you’ll never own the vehicle outright.

Buying: On the other hand, buying a used car gives you full ownership and the ability to customize your ride. Plus, you’ll save money in the long run since you won’t have to keep leasing new cars.

Final Thoughts and Action Steps

Used car financing in Milledgeville doesn’t have to be overwhelming. By understanding your options, improving your credit score, and negotiating smartly, you can find a loan that fits your budget and lifestyle. Remember to shop around, read the fine print, and never hesitate to walk away from a bad deal.

Now that you’ve got the knowledge, it’s time to take action! Start by researching local lenders and online options, and don’t forget to compare rates. Once you’ve found the right loan, make sure to read the contract carefully before signing. And if you have any questions or need further guidance, feel free to leave a comment below or share this article with a friend who might find it helpful.

Happy car shopping, and may your next ride bring you years of reliable service!

Detail Author:

- Name : Emilia Huel V

- Username : johnson.swaniawski

- Email : tyshawn42@rippin.com

- Birthdate : 1993-04-13

- Address : 547 Malvina Plain Wunschchester, IN 07229

- Phone : 1-283-507-5315

- Company : Kassulke, Waelchi and Crooks

- Job : Preschool Teacher

- Bio : Animi optio adipisci qui ut. Eaque accusamus inventore ut et et. Totam earum sed reprehenderit soluta laudantium. Consequatur temporibus vel quia et.

Socials

linkedin:

- url : https://linkedin.com/in/lkoepp

- username : lkoepp

- bio : Quae qui qui facilis qui quasi.

- followers : 3322

- following : 2954

instagram:

- url : https://instagram.com/ludie8139

- username : ludie8139

- bio : Ut at pariatur magni eveniet ut est. Dolores beatae explicabo expedita at saepe.

- followers : 1954

- following : 2867