Colorado Unemployment 1099-G: A Must-Read Guide For Every Taxpayer

**So, you’ve probably heard about this Colorado unemployment 1099-G thing, right? Maybe it popped up in your mailbox or maybe you’re just trying to figure out what the heck it means for your taxes. Well, buckle up because we’re about to break it all down in a way that’s easy to digest. Whether you’re a first-time filer or just need a refresher, understanding your 1099-G is crucial if you want to avoid any nasty surprises come tax season. This guide will give you the lowdown on everything you need to know about Colorado unemployment and how it ties into your 1099-G form.**

Let’s be real here—tax season can feel like a rollercoaster of emotions. One minute you’re feeling confident, and the next, you’re scratching your head wondering why there’s a random form with numbers you don’t recognize. If you received unemployment benefits in Colorado, chances are you’ll also receive a 1099-G. But don’t panic yet! We’re here to explain exactly what it is, why it matters, and how it impacts your tax return.

Now, before we dive deep into the nitty-gritty details, let’s set the stage. The 1099-G form is basically a report card from the government telling you how much unemployment compensation you received during the year. And guess what? That money is taxable. So, if you’re thinking, “Wait, does that mean I owe more taxes?”—you’re not alone. Stick around, and we’ll walk you through step by step so you can handle this like a pro.

- Kayson Myler Age Unveiling The Rising Starrsquos Journey

- Mckinley Richardson Age The Rising Star Unveiled

What Exactly Is Colorado Unemployment 1099-G?

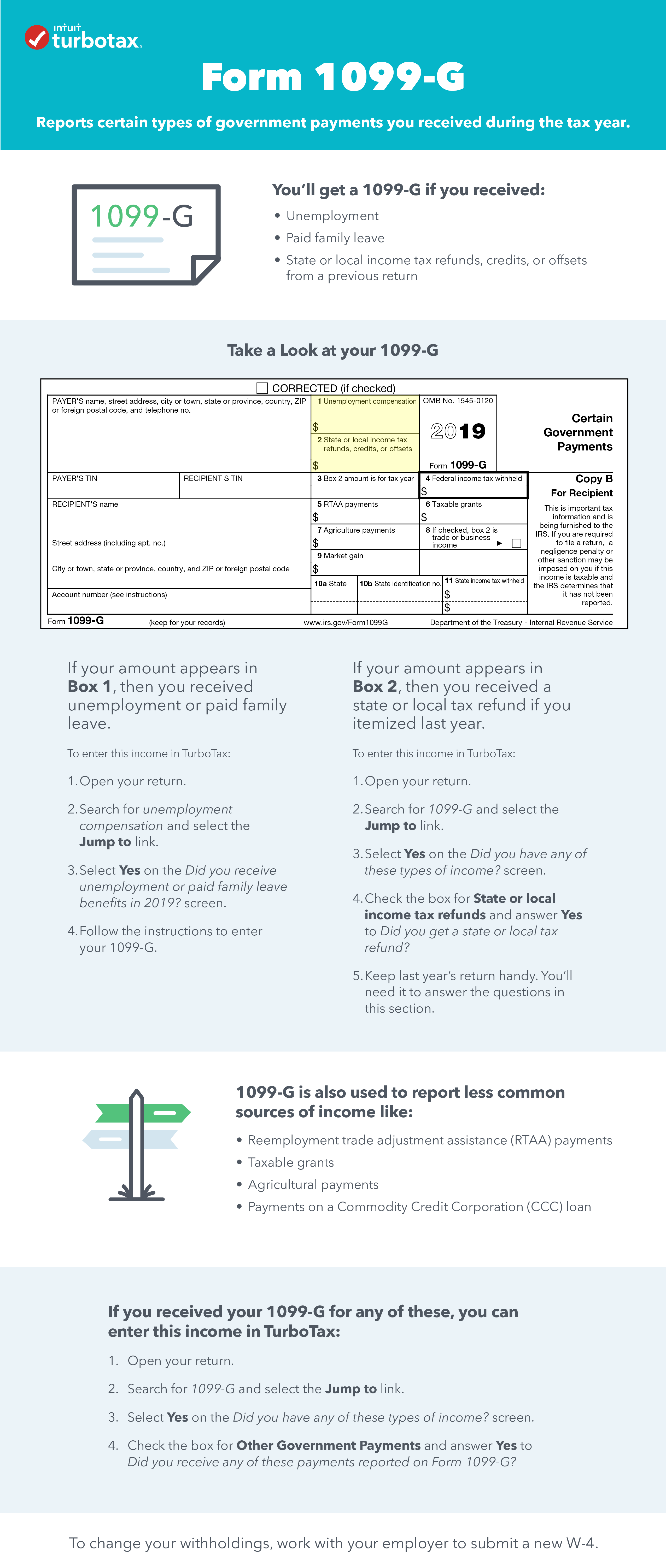

Alright, let’s start with the basics. The Colorado unemployment 1099-G is an official IRS document that reports any payments you received from state or local governments. This includes unemployment benefits, which are considered taxable income by Uncle Sam. If you collected unemployment compensation in Colorado, you’ll likely receive this form around January or February each year.

Here’s the kicker: even though unemployment benefits are designed to help you during tough times, they’re still treated as income by the IRS. That means you might owe federal and state taxes on that money. But don’t freak out just yet—there are ways to manage this, and we’ll cover those later. For now, just remember that the 1099-G form is your key to reporting these payments accurately on your tax return.

Breaking Down the 1099-G Form

Now that you know what the 1099-G is, let’s talk about what’s actually on the form. It’s basically a snapshot of your unemployment payments for the year. Here’s what you’ll see:

- Kristi Noem Sports Illustrated A Deep Dive Into Her Journey And Legacy

- Alice Rosenblum Leaked Photos The Truth Behind The Controversy

- Box 1: Shows the total amount of unemployment compensation you received.

- Box 3: Lists any federal income tax withheld from your unemployment benefits.

- Box 16: Indicates the amount of unemployment compensation subject to Colorado state taxes.

Each box provides important information that you’ll need when filing your taxes. And trust us, accuracy is key here. Even a small mistake can lead to big headaches later on.

Why Does Colorado Unemployment 1099-G Matter?

Here’s the deal: the 1099-G isn’t just some random piece of paper. It plays a critical role in your tax filing process. Without it, you might miss out on claiming deductions or credits you’re entitled to—or worse, overpay your taxes. That’s why it’s essential to keep this form safe and sound until you’ve filed your return.

Another thing to keep in mind is that the IRS matches the information on your 1099-G with what you report on your tax return. So, if there’s a discrepancy, you could end up with a letter from the IRS asking for clarification—or worse, penalties. To avoid all that hassle, make sure your numbers match up perfectly.

Common Mistakes to Avoid

Let’s face it—tax forms can be confusing. Here are a few common mistakes people make with their 1099-G:

- Forgetting to report unemployment compensation as taxable income.

- Not accounting for federal or state taxes withheld from your benefits.

- Misplacing the form or failing to include it with your tax filing.

By staying vigilant and double-checking your work, you can save yourself a ton of stress. Plus, you’ll be more likely to get the refund you deserve—or at least minimize what you owe.

How to Handle Colorado Unemployment Taxes

So, you’ve got your 1099-G in hand. Now what? The next step is figuring out how to handle the taxes on your unemployment benefits. There are a few options to consider:

Option 1: Withhold Taxes from Your Benefits

When you sign up for unemployment, you usually have the option to have federal taxes withheld from your payments. This works similar to how taxes are taken out of your paycheck at a regular job. If you chose this option, you’ll see the amount withheld listed in Box 3 of your 1099-G.

Pro tip: Even if you had taxes withheld, it’s still a good idea to set aside extra money for state taxes. Colorado has its own tax rates, and you don’t want to get caught off guard come April 15th.

Option 2: Pay Estimated Taxes

If you didn’t opt for tax withholding, you’ll need to pay estimated taxes throughout the year. This involves making quarterly payments to both the IRS and the Colorado Department of Revenue. It sounds like a hassle, but it’s actually a smart move if you want to avoid a massive bill at tax time.

Here’s how it works: Divide your estimated tax liability by four and send in payments every three months. You can use IRS Form 1040-ES for federal taxes and the Colorado DR 1057 for state taxes. Just be sure to keep track of your payment dates so you don’t miss a deadline.

Understanding Tax Deductions and Credits

Now that we’ve covered the basics of reporting your unemployment income, let’s talk about ways to reduce your tax burden. There are several deductions and credits available that could lower your overall tax liability. Here are a few to keep in mind:

Standard Deduction

Most taxpayers qualify for the standard deduction, which is a fixed amount you can subtract from your income. For the 2022 tax year, the standard deduction for single filers was $12,950, while married couples filing jointly could deduct $25,900. If you itemize your deductions, you might be able to claim even more.

Child Tax Credit

If you have kids, you might qualify for the Child Tax Credit. This credit can reduce your tax bill by up to $2,000 per qualifying child under age 17. And if you’re lucky, you might even get a refundable portion of the credit.

Earned Income Tax Credit (EITC)

The EITC is a big deal for low- to moderate-income taxpayers. It’s designed to help offset the burden of paying taxes on earned income, including unemployment benefits. Depending on your income and family size, you could receive a substantial credit that reduces your tax liability—or even gives you a refund.

Dealing with IRS Issues

Sometimes, things don’t go as planned. Maybe you made a mistake on your tax return, or maybe the IRS flagged your 1099-G for further review. Whatever the case, it’s important to know how to handle IRS issues calmly and effectively.

Responding to IRS Notices

If you receive a notice from the IRS, don’t panic. Most of the time, it’s just a request for more information or a correction to your tax return. Carefully read the notice and follow the instructions provided. If you’re unsure what to do, consult with a tax professional or reach out to the IRS directly for clarification.

Avoiding Penalties and Interest

The best way to avoid penalties and interest is to file your taxes on time and pay what you owe. If you can’t pay in full, you might be able to set up an installment agreement with the IRS. Just remember, the longer you wait, the more interest and penalties will pile up.

Planning for Future Tax Seasons

Now that you’ve got a handle on the current year’s taxes, it’s time to think ahead. Here are a few tips to help you prepare for future tax seasons:

Keep Good Records

Document everything related to your unemployment benefits, including the dates you received payments, the amounts, and any taxes withheld. This will make it much easier to file your taxes next year—and help you spot any discrepancies early on.

Stay Informed

Tax laws change all the time, so it’s important to stay up-to-date with the latest rules and regulations. Follow trusted sources like the IRS website or consult with a tax advisor to ensure you’re always in compliance.

Conclusion

There you have it—everything you need to know about Colorado unemployment 1099-G. From understanding the form itself to navigating the tax implications, we’ve covered it all. Remember, the key to a stress-free tax season is preparation and attention to detail. By staying organized and informed, you’ll be able to tackle your taxes with confidence.

Before you go, take a moment to reflect on what you’ve learned. Did you discover something new about unemployment taxes? Or maybe you found a deduction or credit you didn’t know about before. Either way, we hope this guide has been helpful. Now, it’s your turn to take action. Share this article with a friend, leave a comment below, or check out our other tax-related content for even more insights.

Table of Contents

- What Exactly Is Colorado Unemployment 1099-G?

- Breaking Down the 1099-G Form

- Why Does Colorado Unemployment 1099-G Matter?

- Common Mistakes to Avoid

- How to Handle Colorado Unemployment Taxes

- Understanding Tax Deductions and Credits

- Dealing with IRS Issues

- Planning for Future Tax Seasons

- Conclusion

Detail Author:

- Name : Miss Tamia Bartoletti

- Username : sarmstrong

- Email : lindsey.rippin@vonrueden.com

- Birthdate : 1987-09-29

- Address : 91224 Kiehn Trafficway Priceside, GA 81776

- Phone : 1-816-448-3120

- Company : Williamson Inc

- Job : Radiation Therapist

- Bio : Voluptatem vel non voluptatibus voluptatum nisi enim. Ut quo quo maxime occaecati aut. Velit totam eum sequi magnam odit sit omnis. Impedit id quas id soluta harum omnis id.

Socials

instagram:

- url : https://instagram.com/allison.white

- username : allison.white

- bio : In sed quo distinctio. Dolore quia at quo. Dolores atque rem quae explicabo inventore non.

- followers : 6850

- following : 1694

facebook:

- url : https://facebook.com/white1987

- username : white1987

- bio : Odit dolores porro nisi dolores. Id est veritatis voluptatem ut culpa magni.

- followers : 1888

- following : 1126

tiktok:

- url : https://tiktok.com/@allison6434

- username : allison6434

- bio : Quis saepe sequi et inventore.

- followers : 2068

- following : 1694